CT DRS C-3 UGE (formerly C-3) 2011-2024 free printable template

Show details

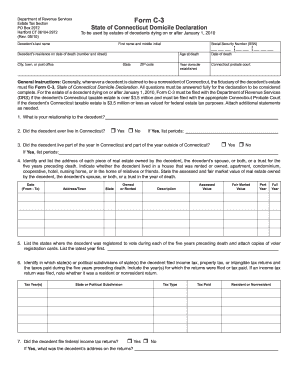

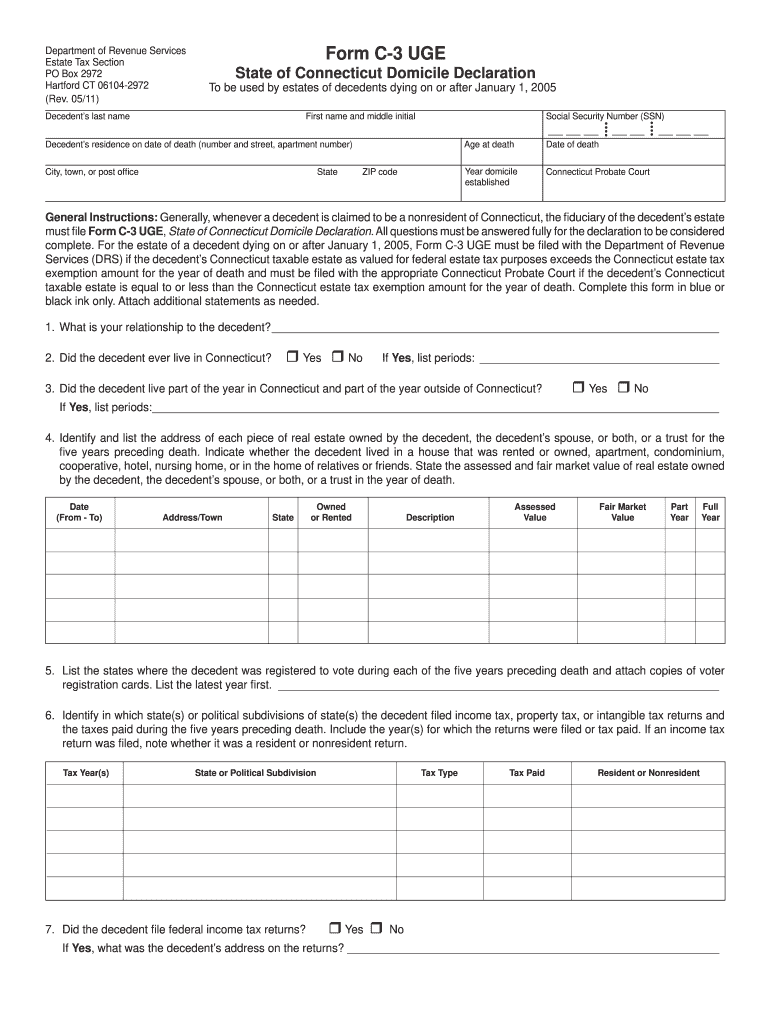

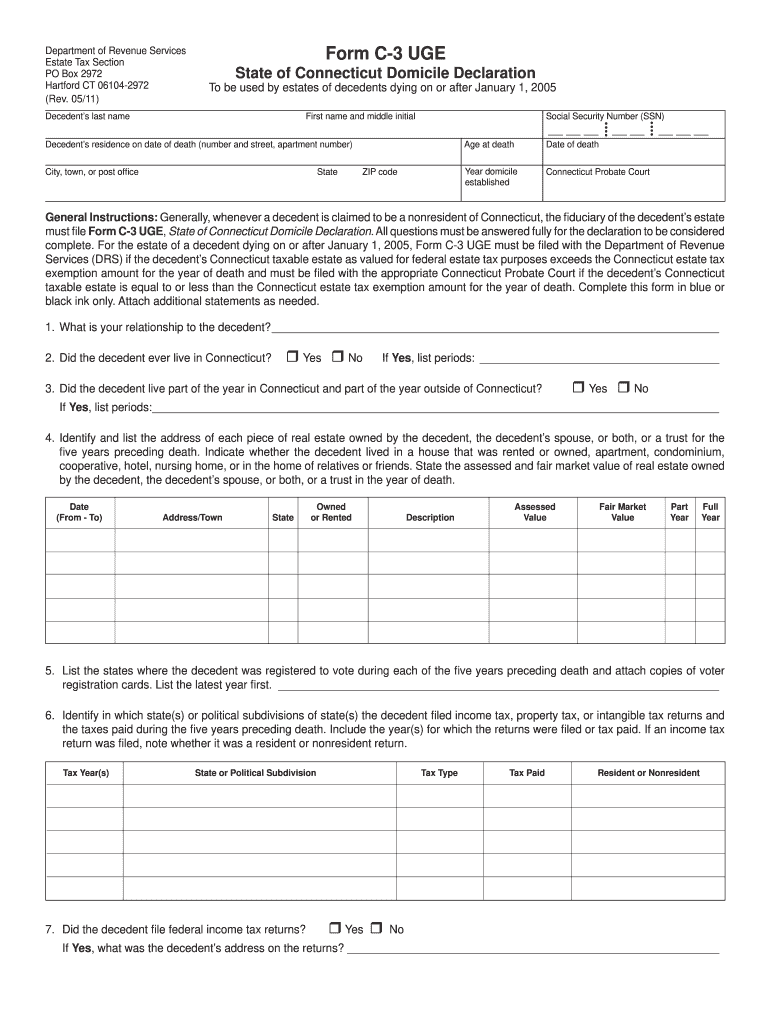

18. Provide the place of the decedent s death and burial. Attach copies of the decedent s death certi cate and obituaries in the newspapers Form C-3 UGE Rev. 05/11 Page 2 of 3 19. Department of Revenue Services Estate Tax Section PO Box 2972 Hartford CT 06104-2972 Rev. 05/11 Form C-3 UGE State of Connecticut Domicile Declaration To be used by estates of decedents dying on or after January 1 2005 Decedent s last name First name and middle initial Decedent s residence on date of death number...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your revenue c connecticut 2011-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue c connecticut 2011-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenue c connecticut online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form c 3 uge. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

CT DRS C-3 UGE (formerly C-3) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out revenue c connecticut 2011-2024

How to fill out Connecticut forms:

01

Start by gathering all the necessary information and documents required for the specific form you need to fill out.

02

Read through the instructions carefully to understand the requirements and any specific guidelines for filling out the form accurately.

03

Begin by providing your personal information, such as your name, address, and contact details, in the designated sections of the form.

04

Follow the steps outlined in the form to input any additional information, such as employment history, educational background, or financial details, if required.

05

Double-check all the information you have entered to ensure accuracy and completeness.

06

Sign and date the form in the appropriate sections.

07

If the form requires any supporting documentation, make sure to attach the necessary files or provide them as indicated.

08

Review the completed form one last time before submitting it to ensure everything is filled out correctly and nothing is missing.

09

Follow the instructions provided on how to submit the form, whether it is online, by mail, or in person.

Who needs Connecticut forms:

01

Individuals who are residents of Connecticut and need to complete various legal or administrative processes, such as tax filings, voter registration, or applying for state benefits, may need Connecticut forms.

02

Connecticut businesses, both small and large, may also need different types of forms for purposes such as registering a business entity, filing sales tax returns, or obtaining necessary licenses and permits.

03

Professionals working in regulated industries, such as healthcare providers or real estate agents, may require specific forms related to licensing or certification processes in Connecticut.

Video instructions and help with filling out and completing revenue c connecticut

Instructions and Help about ct c 3 form

Fill connecticut preceding estate : Try Risk Free

People Also Ask about revenue c connecticut

What is the CT 1040V form?

What is a 1310 form in CT?

Who must file Form CT 1040NR?

Is a non resident required to file income tax return?

Who must file a CT nonresident return?

What is the CT 8822 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is connecticut forms?

Connecticut Forms is an online database of forms and documents provided by the state of Connecticut. It includes forms for filing taxes, registering a business, or obtaining a license. The database is organized by category, and all forms can be downloaded in PDF format.

Who is required to file connecticut forms?

Anyone who has earned income from Connecticut sources is required to file Connecticut tax forms. This includes residents, nonresidents, and part-year residents. Corporations, estates, trusts, and other entities must also file Connecticut tax forms.

How to fill out connecticut forms?

1. Download the form you need from the Connecticut Department of Revenue Services website.

2. Read the form instructions carefully.

3. Gather the required documents and information needed to complete the form.

4. Fill out the form using the instructions provided.

5. Double check the information before submitting the form.

6. Submit the form either online or mail it to the address provided on the form.

What is the purpose of connecticut forms?

The purpose of Connecticut forms is to provide businesses and individuals with the forms they need to complete various tasks related to taxation, business registration, and other activities related to the state of Connecticut. Forms include those for filing taxes, applying for business registration, and other required documents.

What information must be reported on connecticut forms?

The following information must be reported on Connecticut forms:

1. Personal information, including name, Social Security number, date of birth, and address.

2. Employer information, including name, address, and contact information.

3. Income information, including wages, salaries, tips, and other income.

4. Tax withholding information, including federal, state, and local taxes.

5. Deduction and credit information, including any eligible deductions or credits.

6. Payment information, including payment methods and amounts.

When is the deadline to file connecticut forms in 2023?

The deadline to file Connecticut forms in 2023 is April 15th. However, please note that this information is subject to change and it's recommended to verify the deadline with the Connecticut Department of Revenue Services or consult a tax professional.

What is the penalty for the late filing of connecticut forms?

The penalty for the late filing of Connecticut forms varies depending on the specific form and the length of the delay. In general, Connecticut imposes a penalty of 10% of the tax due for each month or part of a month that the return is late, up to a maximum penalty of 100% of the tax due. Additionally, interest is charged on any unpaid tax at a rate of 1% per month or part of a month, from the original due date of the return until the tax is paid in full. It is important to note that these penalties and interest charges can add up quickly, so it is advisable to file tax returns on time to avoid unnecessary financial burden.

How can I send revenue c connecticut for eSignature?

Once your form c 3 uge is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find connecticut forms?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the connecticut death in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in connecticut certificate without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your ct state declaration form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Fill out your revenue c connecticut 2011-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Connecticut Forms is not the form you're looking for?Search for another form here.

Keywords relevant to connecticut documents form

Related to ct state domcile

If you believe that this page should be taken down, please follow our DMCA take down process

here

.